Andy Dodge & Associates

Latest News

- October Sales: Volume Strengthens

- September Sales: Easing Back

- August Sales: Topsy Turvy

- July Sales: Taking a Breather

- June Sales: Serious Mark-downs

- May Sales: Suffering a Relapse

- April Sales: Holding Tight

- March Sales: Highs and Lows

- February Sales: Showing a Comeback

- January Sales: Not Much of a Start

Monthly archives

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

Search

January Sales: Catching our Breath

A busy December in Westmount real estate meant agents had to catch their respective breaths in January, it appears, and try to find listings for what could be a busy spring season.

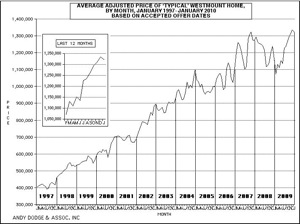

Only four home sales were posted in Westmount as having been negotiated in January, compared with a record 18 reported for December. But those include one at more than $2 million and another just over $1.5 million, which indicates that the price scale is no longer being driven by the bottom of the market. Average price of the four sales is $1,510,625, and the average markup over city assessment is 34.5 percent, with the range from 20.7 percent to 56.9 percent. Only one of the sales of single-family houses was less than $1 million.

Of course, with holidays and extended vacations we can expect that more sales will eventually be posted with January dates, but the four strengthen our view that the market has recaptured all of the losses incurred during 2008. Still, there are plenty of houses available at the top of the market — over $2.5 million — which are not moving at all.

Only one condominium sale was posted in January, but even that showed signs of confidence in the Westmount market, with a price of $2,200,000 for a two-storey condo in one of Westmount’s most prestigious buildings. Because it was only one sale, it is hard to make any statistics with it, but we can say that the market here is pretty much at the same level as it was in mid-2008, when it peaked out at an average $655,000 for a condominium with a tax value of $557,300.

Adjacent-Westmount sales in January included one house on Redpath Crescent and another on Trafalgar Road, a condominium in the Trafalgar Apartments, 3980 Côte des Neiges, and another at 2000 Claremont Avenue, corner de Maisonneuve. No house sales have been reported so far this year in either eastern Notre Dame de Grâce or the Circle Road area.

Agents still are complaining about the lack of listings, and it appears there is plenty of demand. Of the four sales, the lowest-priced sold in a day at almost the full asking price, while the highest-priced took 300 days to sell, boosting the average days-on-market for the month to 111, but this is actually lower than the December average of 179 days.

Posted by andy  Posted in: Monthly Analysis

Posted in: Monthly Analysis  No Comments »

No Comments » ![]() January 2010

January 2010