Andy Dodge & Associates

Latest News

- April Sales: Goin’ No Place

- March Sales: Getting Ready

- February Sales: Low Volume, Prices

- January Sales: On Hold

- December Sales: Pulling Back

- November Sales: Two over $10M

- October Sales: Volume Strengthens

- September Sales: Easing Back

- August Sales: Topsy Turvy

- July Sales: Taking a Breather

Monthly archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

Search

April Sales: Staying on Top

Download the Graph

Download the Graph

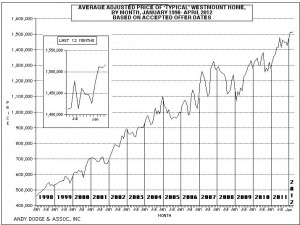

Westmount real estate prices stayed above the $1.5 million average price in April, representing the third straight month that they have cleared that level.

With 15 sales in the month, only two were over $2 million, the highest price at $3,150,000, while four sales were for less than $1 million, the lowest at $825,000. Only one of the sales went for less than valuation, and that one involved property which, according to the listing, probably will be demolished. The average markup was only 17 percent, with only three higher than 30 percent, but the effect has been to keep the value of the “typical” Westmount house, with a valuation of $1,201,709, above the $1.5 million mark.

Six of the 15 properties were on the market for more than 200 days, boosting the average days-on-market to 127 days compared with 117 days in March. We would suggest that in many of these cases the market finally rose to meet the expectations of the sellers, rather than having the sellers reduce their prices to find hesitant buyers. Volume is slightly below average, thanks mainly to the million-dollar prices, but in fact it has been at about the same level for the past four years.

Only one condominium sale was reported in April after 15 sales were posted in the first quarter of the year, with prices ranging from $305,000 to $1,550,000 and the average markup at 17 percent, about the same as for one- and two-family dwellings. This does not include the new condos at 1250 Greene which have yet to be evaluated, nor the 10 co-op apartments, seven of which were at Westmount Square and another two at 300 Lansdowne Avenue. There were no co-op sales in April, however.

Interest lagged, too, in adjacent-Westmount districts, with only two new sales just west of the city limits and one to the east, with a slight rise in prices. There was more interest in purchasing condominiums in these districts, mostly made-over duplexes, and markups were generally lower than they had been earlier in the year. Five of the 10 sales this year in eastern Notre Dame de Grâce have been on Marlowe Avenue and more houses there have come on the market in recent weeks. Prices in that district range from $746,000 to $935,000 with one over $1 million; as Westmount prices move above the $1.5 million mark we may see more sales in this district moving over the $1 million threshold.

Posted by andy  Posted in: Monthly Analysis

Posted in: Monthly Analysis  No Comments »

No Comments » ![]() April 2012

April 2012