Andy Dodge & Associates

Latest News

- April Sales: Goin’ No Place

- March Sales: Getting Ready

- February Sales: Low Volume, Prices

- January Sales: On Hold

- December Sales: Pulling Back

- November Sales: Two over $10M

- October Sales: Volume Strengthens

- September Sales: Easing Back

- August Sales: Topsy Turvy

- July Sales: Taking a Breather

Monthly archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

Search

January Sales: Not Much of a Start

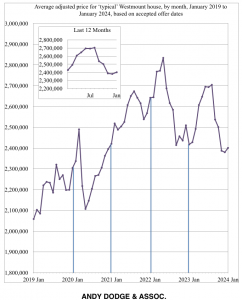

The year 2024 got off to a slow start with only four Westmount sales logged by local agents and only one those selling above the municipal valuation. This is the tale of a market that dropped badly when the pandemic first struck in 2020, then climbed with the rest of the market by offering extra bedrooms and home offices for a changing population. That “bubble” receded by mid-2022, then struggled back last spring but dropped off as mortgage interest rates successfully tempered the real estate market.

Among the four home sales, the prices ranged from $1.7 to $4.2 million, the latter offering a mark-up over the city tax value of only 1.3 percent. The others all went below valuation by as much as 15.4 percent; making this the fourth consecutive month that the ratio has been negative. Though there may be a slight upward stagger in the January figure, low volume often distorts the figures around the holiday season. What remains to be seen is whether the new year brings a strong increase in prices, as has happened in earlier years, or whether the slide which started last August will continue.

Agents are bringing new product onto the market in a hurry — there were 89 listings for Westmount houses as of mid-February, an increase of 15, or 20%, in a month. While still none are asking less than $1,000,000, there were more listings in each million-dollar category, and even three more house rentals than were being offered a month prior.

Only two condominiums sold in January, one a penthouse at Château Westmount Square, 4175 St. Catherine St., which brought an offer of $4,600,000, the other in a smaller St. Catherine St. building, for $590,500. The huge discrepancy between the two makes it impossible to compare; they will be drawn into a first-quarter time period once the February and March sales are added.

The only January sales in adjacent-Westmount came in the Côte des Neiges area north of the city limits. Two houses there sold for prices of $820,000 and $1,930,000, and a duplex-type condominium there sold for $687,000. We keep watching the sales on Roslyn Ave. between the city limits and Queen Mary Rd.: after nine sales were posted during 2023, three more houses were listed at the time of writing.

Posted by andy  Posted in: Monthly Analysis

Posted in: Monthly Analysis  No Comments »

No Comments » ![]() January 2024

January 2024