Andy Dodge & Associates

Latest News

- May Sales: Market Slowing Down

- April Sales: Goin’ No Place

- March Sales: Getting Ready

- February Sales: Low Volume, Prices

- January Sales: On Hold

- December Sales: Pulling Back

- November Sales: Two over $10M

- October Sales: Volume Strengthens

- September Sales: Easing Back

- August Sales: Topsy Turvy

Monthly archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

Search

October Sales: Nothing Under $2m

The Westmount real estate market appears to be rounding the bend, to the delight of optimistic homeowners who might be willing to wait a month or two before putting their house on the market. The typical pattern of local real estate prices is to show some hesitation in the end-of-year period, generally between November and February. This may be moved forward or backward by other economic and political forces or — in 2020 — the initial crash caused by the pandemic and new rules for showing houses.

Five houses sold in Westmount in December, rounding out the year with 114 sales, the lowest volume for any year since 1994, just before the second provincial referendum. This time, though politics (Bills 21 and 96) may be playing a part in the decline, more of it can be explained by the climbing interest rates and something of a post-pandemic return to the office, which is making Westmount’s large houses slightly less important than they had been, say, a year ago.

December included one $4,100,000 sale and three of the four other sales brought less than $2 million each, for an average $2,301,900, but in fact the average mark-up over valuation climbed to 42.2 percent, up from 32.5 percent in November, which allowed for the adjusted average to climb slightly. Latecomers were added to the October and November sales lists, changing those numbers slightly (October still has the distinction of posting no sale under $2 million) but indicating there had been relatively little market movement through the late autumn months.

Various clients took their houses off the market over the holidays and have yet to re-list them, so there are only 83 houses on the market in mid-January compared to 99 listed a month earlier. One house now is listed under $1 million, the first since one was briefly put on the market in September and then taken off without a sale. No houses sold in 2022 for less than $1 million; in fact the last time a price was posted below $1 million was jn January, 2021.

Volume remained strong in Westmount’s condominium market in the last quarter of 2022, when nine sales were posted (four of those in December), indicating an average price of $878,167 and an average mark-up over valuation of 18.5 percent. The raw average sale price is the first time since the first quarter of 2020 that the average is less than $1 million; only two of the sales in the fourth quarter were for prices over $1 milion, and one other was a bachelor apartment which sold for only $280,000, whereas the entire year’s next-lowest sale price was $657,000. All of the condos sold in the fourth quarter were in apartment buildings, none were converted duplexes or triplexes.

House rental listings dropped from 33 to 27, though three new rental contracts were negotiated in December, an indication that market might be picking up steam early in the year. Among house rentals, the range for 2022 was between $3,210 and $14,000 per month, and those now on the market are asking between $4,200 and $15,000 per month.

Volume tailed off again in Westmount real estate in October, but the most exciting news is the that none of the five sales negotiated that month was for less than $2,000,000. This is something of a record, the first time in Westmount’s history there have been no sales under $2 million.

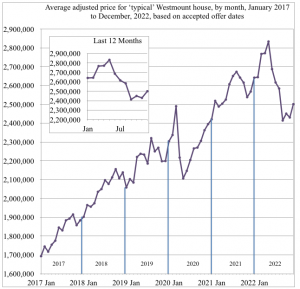

Despite that, the adjusted average price of the standard Westmount house has been dropping almost steadily, from a record-high above $2.8 million to the $2.4 million mark, but the serious problem is lack of volume: While the first four months of 2022 produced an average of 15 sales each, that average in the last six months is 6.7, and the highest monthly number of sales is eight, in August.

One Westmount house sold in October for $7,250,000, the third-highest price this year, for a stately mansion in the east-central part of the city. The lowest price, exactly $2,000,000, went for a semi-detached house on Sunnyside Ave. west of Lexington Ave. And while 23 houses were asking less than $2 million on the market in mid-October, only a few had been on the market more than 90 days. Thus, we are moving very slowly from a seller’s to a buyer’s market, but the demand at the top appears to be holding steady.

Only one month so far this year has not had a price agreement of less than $5 million. There have been three house sales over $7 million and another three over $6 million. While such houses as the one built by Hon. Leo Kolber were negotiated in late 2020, only three sales over $6 million were posted by agents in all of 2021.

One late-September sale of a condominium at Château Westmount Square, 4175 St. Catherine St., was posted in October, representing both the highest price for a condo ($2,715,000) in the third quarter of the year and the highest mark-up over valuation (61 percent). No other condo sales were posted for October, thus there is nothing to report yet for the fourth quarter of 2022.

As of mid-October, there were 100 houses on the market in Westmount, up three from a month earlier but up a whopping 19 from the same period a year ago. Of the current 100 listings, 28 are asking between $1,000,000 and $2,000,000, up 10 from a year ago, while 37 are in the 2 million bracket, up only four from a year earlier.

This is another indication that the $2 million bracket is becoming the norm in Westmount, and buyers who have $1+ million available are just starting to look outside the city limits, mostly in the “Golden Square Mile,” where three houses sold between $1,800,000 and $2,200,000 in October. The other adjacent-Westmount areas have only seen shares of duplexes or condo apartments sold. We expect to see a shift of interest to this area over the holiday season while we wait to find out what next spring has in store for Westmount.

Posted by andy  Posted in: Monthly Analysis

Posted in: Monthly Analysis  No Comments »

No Comments » ![]() October 2022

October 2022