Andy Dodge & Associates

Latest News

- April Sales: Goin’ No Place

- March Sales: Getting Ready

- February Sales: Low Volume, Prices

- January Sales: On Hold

- December Sales: Pulling Back

- November Sales: Two over $10M

- October Sales: Volume Strengthens

- September Sales: Easing Back

- August Sales: Topsy Turvy

- July Sales: Taking a Breather

Monthly archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

Search

December Sales: A Busy Month

Thirteen sales agreements were posted in December, making that the third-busiest month of 2019. Normally December is the weakest month of the year for negotiating sales; this year agents posted more sales in December than in any months except May and September. The total for last year is only 131 sales compared to 151 sales in 2018 and an average of almost 168 sales per year. Except for 97 sales in 1994, leading up to the second provincial sovereignty-association referendum, this is the lowest number of one- and two-family dwelling sales in Westmount in the past thirty years.

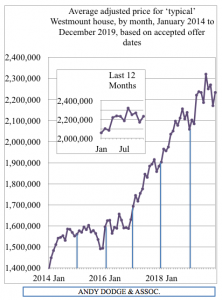

Prices, on the other hand, are as strong as ever, perhaps technically not as strong as they were in August but basically with an average adjusted price in the range of $2,200,000 to $2,300,000, where it has been since April. The average mark-up compared to 2017 valuation moved up to 45.5 percent and the price range went from $950,000 to $3,300,000, with four sales above $2 million. While there were none of the very high-priced sales to pull the average back over $2 million, the average for 2019 stayed above $2 million and if compared to the “typical” Westmount house with a (theoretical) 2017 valuation of $1,575,722, the average 2019 value would move up to $2,184,274.

Only two new condominium sales were posted in December, but they brought the fourth-quarter volume to 12 sales, almost all in apartment buildings but with the lowest price for a flat in a Claremont Ave. triplex at $570,000. They moved up from there to $2,200,000 for a penthouse at 215 Redfern Ave., and included four sales at 1 Wood Ave. The fourth-quarter average mark-up was 28.2 percent, thus much lower than the average for one- and two-family dwellings, and in fact the average mark-up has dropped from 35.1 percent in the third quarter of the year. Still, the adjusted average price of Westmount’s condominiums was just over $1,113,000; it has been over $1 million since the second quarter of 2018.

Things were busy in adjacent-Westmount areas, as well, with five new single-family sales posted in three districts in December. It is significant to note that, among the main adjacent-Westmount districts, the year 2019 saw a decrease in volume (one- and two-family dwellings) for the southern Côte des Neiges district and the “Golden Square Mile,” with increases for eastern Notre Dame de Grâce and the western part of downtown Montreal. In all districts (except Shaughnessy Village) the average price of a house is over $1.3 million, up by 8-16 percent in every district except eastern N.D.G. As we moved into the holiday season the number of available house listings in Westmount dropped off sharply, from 121 to 95, now with only one house asking under $1 million (at $889,000) while there are still five asking more than $10 million, but the numbers have shrunk in every other price category. No new rental agreements were negotiated in December, apparently, thus 41 rentals in 2019 compared to 47 in 2018; however, five of those 2019 rentals were for more than $10,000 a month, while none were posted at that level in the previous year.

And so we begin the new year with a healthy real estate market; indeed, while the median price for the Island of Montreal in December was $549,500, we’re talking about four times that amount for your “typical” Westmount house. We expect things to pick up as winter turns into spring, with a healthy economy and few clouds on the horizon.

Posted by andy  Posted in: Monthly Analysis

Posted in: Monthly Analysis  No Comments »

No Comments » ![]() December 2019

December 2019