Andy Dodge & Associates

Latest News

- April Sales: Goin’ No Place

- March Sales: Getting Ready

- February Sales: Low Volume, Prices

- January Sales: On Hold

- December Sales: Pulling Back

- November Sales: Two over $10M

- October Sales: Volume Strengthens

- September Sales: Easing Back

- August Sales: Topsy Turvy

- July Sales: Taking a Breather

Monthly archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

Search

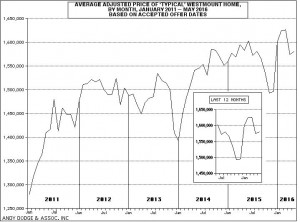

May Sales: Volume Soars

Download the Graph

Download the Graph

Volume soared in May real estate in Westmount, with 26 one- and two-family sales compared to only 15 per month in the previous two months. That is the most we have recorded in a month since May of 2011 and one of the busiest months in recent Westmount history.

All but five of the sales cleared the $1 million mark and four were for more than $2 million, with the top price at $3,200,000. The lowest price was $652,500 and two others were for less than $800,000. Seven sales were logged at prices below municipal evaluation, the lowest at only 68 percent of tax value, while one house below Sherbrooke Street sold for 91 percent above the city figure, by far the highest mark-up of the month.

So far this year agents have logged nine sales over $2 million, of which six have been for less than tax value, compared to an average mark-up of eight percent, so there is every indication that the gap between the more expensive houses and the mid-range homes is narrowing somewhat. Still, the fact that the May list includes four of the nine sales over $2 million might mean that the market for these houses is starting to come back.

Also sold in May were four condominiums — three apartments and a portion of a former triplex — and one co-operative apartment. So far in the second quarter (April and May) a total of seven condominiums brought prices ranging from $370,000 to $1,500,000. Condos on average this year are selling at just about parity with municipal evaluation, and in fact prices have moved little since 2012, the basis for the current valuation roll, so it is possible there will be little change in condo valuations in the 2017 roll.

The buying fervor which gripped Westmount in May did not spread beyond the borders of the city, where more divided or undivided shares of duplexes sold than the five houses, which included one each in the Circle Road area, “Golden Square Mile” and Trafalgar-Daulac areas, and two in eastern Notre Dame de Grâce. Markups indicate that interest in adjacent-Westmount is still strong, and prices are up 2.5 to 9 percent compared to last year.

June is generally a “take-it-easy” month for Westmount real estate, but considering the fervor of May and the very late spring season, we would not be surprised to see another strong month. Because of the heavy May volume, Westmount in mid-June was advertising only 138 active listings, compared to 153 a month earlier, though the number asking over $4 million has jumped from 16 to 20.

-30-

Posted by andy  Posted in: Monthly Analysis

Posted in: Monthly Analysis  No Comments »

No Comments » ![]() May 2016

May 2016