Andy Dodge & Associates

Latest News

- April Sales: Goin’ No Place

- March Sales: Getting Ready

- February Sales: Low Volume, Prices

- January Sales: On Hold

- December Sales: Pulling Back

- November Sales: Two over $10M

- October Sales: Volume Strengthens

- September Sales: Easing Back

- August Sales: Topsy Turvy

- July Sales: Taking a Breather

Monthly archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

Search

November Sales: Easing Off?

Download the Graph

Download the Graph

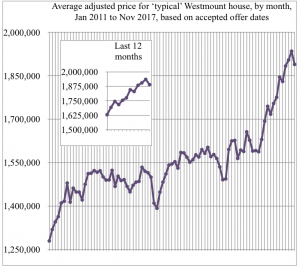

The Westmount real estate market might have taken a tiny respite in November, but that hardly makes up for the incredible climb we have seen in both prices and mark-ups this year, spurred by the growth in Montreal’s and North America’s economy. The adjusted value of Westmount’s “typical” house remained close to $1.9 million for the third month in a row and in fact the raw average price of ten sales was over $2 million, though the average mark-up over valuation dipped by 1 percent. The reason for the high average price is very simple: three of the ten sales were for more than $2 million and as high as $4,900,000. Another sale posted last month but negotiated in October was for $5,280,000, and the second-highest price in November was $4,400,000, so it appears that the big prices are becoming more acceptable. Both of the $4 million-plus sales took more than a year to sell, pulling the average time on the market up to 125 days

On the low side were two sales under $1 million with the lowest price at $820,000. Of the ten November sales, only two involved mark-downs as much as 4.4 percent. Biggest mark-up in November was 56.8 percent, which helped boost the average mark-up to 20.9 percent.

Volume is high, too; though the 172 Westmount sales posted so far this year is less than the 187 year-to-date last year, that figure is higher than for any other year since 2007. Going back to 1986, the average annual volume is 170 one- and two-family sales, so already this year’s volume is above average for the year with the December list still to come.

Only one condominium sale was posted in November (along with a co-op apartment at 2 Westmount Square) but along with five sales in October, the average fourth-quarter price topped the $1 million mark and the average mark-up over valuation was almost 17 percent, up from 12.5 percent in the third quarter and 5.1 percent in the second quarter of the year. Of the six fourth-quarter sales, except for one flat in a former triplex on St. Antoine St. ($385,000), the lowest price for a condo was $865,000, and sale prices went up as high as $1,561,000 for a unit in Château Westmount Square, 4175 St. Catherine St. West. So while the average mark-up of 17 percent is not quite as high as the average 21-22 percent for one- and two-family houses in recent months, certainly the condo market is holding its own against the booming home market.

There was one home sale posted in each of the various adjacent-Westmount districts, except two in the Trafalgar-Daulac area where the average price for the year is just under $1.6 million, playing second-fiddle to the $1.837 million average in the “Golden Square Mile” on the east side of Atwater Ave. The Westmount-adjacent section of Côte des Neiges has an average sale price just over $1 million while the similar section of Notre Dame de Grâce is just under $1 million, as is the Shaughnessy Village sector (though there have only been four home sales there so far this year, so the statistic is weak).

At last check there were only 50 houses listed by agents for sale in Westmount, by far the lowest number of listings in the past two years; in January 2016 there were 117 houses on the market. Of the 50, only two are asking less than $1 million while 14 are asking more than $4 million. Two years ago there were 13 properties asking less than $1 million compared to 15 asking more than $4 million, clear proof that the bottom end of the market is pretty much drained now, though there’s still plenty of opportunity at the top end of the range,

The figures show 36 houses have been rented in Westmount this year and another 28 are available for rent. Of the 36, six are for rates of $10,000 and higher per month, while another four are listed at more than that amount.

Posted by andy  Posted in: Monthly Analysis

Posted in: Monthly Analysis  No Comments »

No Comments » ![]() November 2017

November 2017