Andy Dodge & Associates

Latest News

- April Sales: Goin’ No Place

- March Sales: Getting Ready

- February Sales: Low Volume, Prices

- January Sales: On Hold

- December Sales: Pulling Back

- November Sales: Two over $10M

- October Sales: Volume Strengthens

- September Sales: Easing Back

- August Sales: Topsy Turvy

- July Sales: Taking a Breather

Monthly archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

Search

August Sales: Demand Dwindles

Commitment to the upper portion of Westmount’s home price range appears to have dwindled in mid-summer, with no sales of property over $2 million reported in August, and the actual average price down to $1,283,333 in six sales, though mark-ups over valuation remained strong, averaging 31 percent. One late-July sale in Westmount cleared $2 million, but otherwise there has been very little recently to encourage the higher-priced market.

In August, the six sales ranged from $965,000 — the first under-$1 million sale since May and one of only four so far this year — to $1,650,000, making this the only month not to have a sale over $2 million since January, 2017. The lowest-priced sale was also the lowest mark-up over municipal valuation in August, at 5.7 percent, also the house which had been the longest on the market, 279 days. On the other hand, the highest price of $1,650,000 generated the highest mark-up of 47.2 percent, though that house also spent 203 days on the market. Two others sold in less than a week, so the overall average for the month was 102 days.

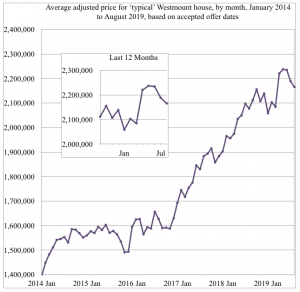

The average mark-up over valuation for August was 30.9 percent, way down from an average for July of 51.9 percent but generally just below the 37-percent average for the year. On that basis, the “typical” Westmount house with a valuation of $1,575,722 would be worth $2,063,340; with extremes removed and averages smoothed, we reach a figure of $2.2 million, continuing a slight downward trend which started in June. Because of the slow volume in July and August, this is no reason to panic, though if the trend continues we may see a significant shift in the local market.

Two condominium sales in August increased the third-quarter sales list for Westmount condos to eight; in fact the highest- and lowest-priced apartments/flats of the quarter were added to the list: $2,185,000 for a high-rise condo at Château Westmount Square, 4175 St. Catherine Street, and $435,000 for one floor of a duplex on Victoria Ave. The average mark-up of third-quarter sales is 34.4 percent, almost the same as for one- and two-family dwellings, with September sales still to be added to the list.

Though July had been very busy in adjacent-Westmount districts, August was almost dormant, with one house sale on Circle Road, one condominium at the Trafalgar Apartments on Côte des Neiges Rd. and two co-op apartments, including a flat in a triplex in Notre Dame de Grâce.

The lethargy in the over-$2 million market has pushed the number of active listings for Westmount houses to 132 from 119 a month earlier, but only four more are in the $2 to $3 million category. Five more houses were rented in August, bringing the total for the year to 33, in a range from $2,900 to $15,000 a month. Another 25 houses are up for rent, the lowest asking price is $4,000 monthly and the highest is $20,000.

Posted by andy  Posted in: Monthly Analysis

Posted in: Monthly Analysis  No Comments »

No Comments » ![]() August 2019

August 2019

Download the Graph

Download the Graph