Andy Dodge & Associates

Latest News

- April Sales: Goin’ No Place

- March Sales: Getting Ready

- February Sales: Low Volume, Prices

- January Sales: On Hold

- December Sales: Pulling Back

- November Sales: Two over $10M

- October Sales: Volume Strengthens

- September Sales: Easing Back

- August Sales: Topsy Turvy

- July Sales: Taking a Breather

Monthly archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

Search

September Sales: Only the Lowly

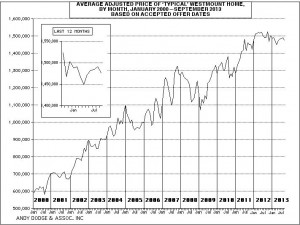

Volume rebounded in September for the lower half of the Westmount real estate market, that is, for houses selling at or less than $1,500,000, but it is still suffering badly for houses over that mark. Only one of 12 properties sold in September exceeded $1.5 million, and none went for more than $2 million.

Two of the year’s lowest house prices were posted in September, doubling the number of sales this year between $500,000 and $600,000. The next two prices were $900,000 and $915,000.

So far this year 11 home sales have been reported above $2 million, and another 66 are asking more than that amount, out of 165 on the market now in Westmount. This compares to 60 over $2 million and 151 overall a month earlier, so the trends are obvious.

In fact, prices were so low that the average price of the September sales dropped to $1,163,000, the lowest raw average price for a month since July last year. However, markups over city valuation stayed strong, an indication buyers are willing to pay for the product, but not in the higher price brackets. The last sale over $2 million posted by agents was negotiated in July, and only three have been settled since April. Depending on how desperate the owners of those big houses are, those high asking prices may have to come down substantially to get that part of the market moving again.

The condominium market inched along with only two sales, bringing the total for the third quarter this year to seven, but in fact one of those two was just over $1,600,000, the highest price paid for a resale condo this year (excluding the new condos at 1250 Greene Avenue). The average markup for the seven condominium sales reached only 12 percent over the 2011 valuation compared to an average 20 percent for the entire year. The figures are not substantial enough to say that buyers are losing interest in condominiums, and in fact if the aging owners of the large houses could sell, they might be ready to pay substantially for some of Westmount’s more expensive condos.

Adjacent-Westmount, which picked up the slack from Westmount’s lack of sales in August, saw only two sales in September: a house on Redpath Crescent and an apartment in the Trafalgar Apartments on Côte des Neiges. While in Westmount prices (in terms of markups) have stayed fairly even compared with last year, in every part of adjacent-Westmount we have seen modest reductions of prices.

Posted by andy  Posted in: Monthly Analysis

Posted in: Monthly Analysis  No Comments »

No Comments » ![]() September 2013

September 2013