Andy Dodge & Associates

Latest News

- May Sales: Market Slowing Down

- April Sales: Goin’ No Place

- March Sales: Getting Ready

- February Sales: Low Volume, Prices

- January Sales: On Hold

- December Sales: Pulling Back

- November Sales: Two over $10M

- October Sales: Volume Strengthens

- September Sales: Easing Back

- August Sales: Topsy Turvy

Monthly archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

Search

January Sales: On Hold

January often is considered a month “on hold” in Westmount real estate circles, as agents recover from a busy year and start preparing for another busy spring market, and this new year was no exception. Only four sales are posted (so far) as having been agreed to in January, though two more house sales were added to the December list. Of the four in January, all were above $2 million and only one sold above the $3 million mark; this is only the second month in which all the sales have been north of $2 million, after seven sales cleared that mark in October, 2022.

Three of the four in January sold for more than their municipal valuation, none higher than a 13.8-percent mark-up, and the fourth with an 11.9-percent mark-down, so the average of the four was only 6.0 percent, again indicating that we can expect little increase in tax values when the new valuation roll covering the years 2026 to 2028 is published this fall.

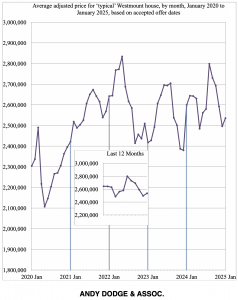

As our graph shows, 2024 was a rather rocky year with a bulge in mid-summer followed by a serious slide in the fall months. It turns out agents posted 140 sales during the year, way up from 114 in 2023 and 118 in 2022, but otherwise slightly below the 148.8 average volume of the past 15 years. The average mark-up over valuation in the first year of the 2023 valuation roll was 1.7 percent, then 7.7 percent in 2024, but these figures are far lower than the average mark-ups for the previous valuation roll (2020-22) when they came in at 17 percent, 32.8 percent and 36.3 percent, respectively.

Four condominiums — including one former duplex and three apartments — all cleared the $1 million mark in January; the lowest was the duplex-condo which went for $1,130,000, while the highest price was an upper-floor apartment at 1 Wood Ave. which sold below valuation for $1,925,000. Higher prices went for two high-rise apartments in Westmount Square, co-op apartments that sold for $2,250,000 and $3,546,000.

For 2024, the adjusted average for condominiums climbed to $1,350,345, up 2.7 percent from 2023, in a price range from $420,000 to $4,600,000.The highest mark-up among condominiums last year was 44.4 percent, the biggest mark-down was 26 percent, with an average for the year of 6.6 percent.

As we move into 2025, buyers are looking at 109 available houses of which 25 are asking less than $2 million and another 35 asking between $2 and $3 million. The lowest-priced house is asking $799,000 but it is lonely; only one other house is asking less than $1 million, at $999,000. Nineteen houses were listed for rent by agents in mid-February, the lowest number since the pandemic. Westmount tallied 48 house rentals at the end of the year, the highest number since we began keeping records in 2016, as was the number of rentals (8) over $10,000.

Only two houses sold in adjacent-Westmount areas in January, one on McDougall Ave. near The Boulevard for $1,535,000, the other on Vendôme Ave. above N.D.G. Ave., for $1,215,000.

Posted by andy  Posted in: Monthly Analysis

Posted in: Monthly Analysis  No Comments »

No Comments » ![]() January 2025

January 2025