Andy Dodge & Associates

Latest News

- October Sales: Volume Strengthens

- September Sales: Easing Back

- August Sales: Topsy Turvy

- July Sales: Taking a Breather

- June Sales: Serious Mark-downs

- May Sales: Suffering a Relapse

- April Sales: Holding Tight

- March Sales: Highs and Lows

- February Sales: Showing a Comeback

- January Sales: Not Much of a Start

Monthly archives

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

Search

September Sales: Almost everything over $1 million

Download the graph

Download the graph

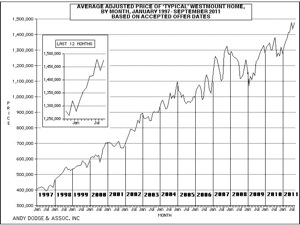

The notion that nearly every homeowner in Westmount is now a millionaire became clear last month as all but one of the eight sales in September topped the $1 million mark. Volume returned to the market after a sluggish August, but still there were no sales over $2 million which appears to be the latest level of resistance. There are some 34 houses currently on the market for more than $2 million but no agreements to pay more than that since July.

The average of eight September sales was $1,336,750 and the adjusted price of the “typical” Westmount house hovered around the $1,475,000 level, showing continued confidence in the local real estate market even as predictions of another recession plague the stock market and the housing market south of the border. The only sub-million sale price was $900,000 and two houses sold for close to $1.7 million.

Average markup in September was 22 percent, which represents the overall market increase since mid-2009, about 10 percent of that in the past eight or nine months. Only one of the eight sales was below evaluation, and the highest markup was 54 percent. On average the houses took 96 days to sell, and it appears only one dropped its asking price during its time on the market, an indication the owners had confidence in the market.

The month also marked the sale of three condominiums, all apartments in high-rise buildings. For the third quarter of 2011 seven condos have sold for an average 28 percent above valuation, only two over $1 million and the rest between $700,000 and $815,000. Three co-op apartments, including two shares of duplexes and one apartment in Westmount Square, for prices in a narrow range between $459,000 and $500,000.

In adjacent-Westmount, another eight sales were posted in September, only one over $1 million while the rest sold for prices between $780,000 and $997,000. It would appear that those looking for prices under $1 million must resort to houses in eastern Notre Dame de Grâce (2 sales in September), southern Côte des Neiges (3 sales) or the older houses in the Trafalgar-Daulac and Golden Square Mile districts (3 sales). Though it is hard to give exact statistics, prices appear to have been improving in these areas, particularly north and west of Westmount.

Posted by andy

Posted by andy ![]() October 2011

October 2011